- #Paying federal taxes for small business how to#

- #Paying federal taxes for small business pro#

- #Paying federal taxes for small business software#

- #Paying federal taxes for small business professional#

Dan Luthi, Partner at Ignite Spot Accounting ServicesĬredit card points are frequently misrecorded, too. You know what you are actually utilizing for marketing spend versus just inventory adjustments. Not that it gains you a massive amount of extra benefit, but it helps you to understand what your business comparability is, so when you’re evaluating at the end of the year in preparation for taxes, looking at the right information. Making sure it’s reported correctly on your financial statements is crucial.

#Paying federal taxes for small business software#

Or use an accounting software that does it for you (more on this later).įree samples are a common misrecorded expense, as Dan Luthi of Ignite Spot explains: “Sometimes people will just adjust out and mark it off as inventory shrinkage when, in reality, it was actually a marketing expense. Pull bank statements to reconcile income and outgoings with receipts or invoices. Speaking of clean data, tax season will be much easier to navigate if you have accurate reports.

Not only will you have clean, accurate records for the expenses you’re writing off, but personal transactions will be kept private. Having separate bank accounts for both business and personal transactions makes tax time easier. The more on top of your business and personal tax records you are, the less likely that the IRS will find anything wrong with these records. One of the simplest ways to get in tax trouble is having personal expenses recorded as business expenses. The first thing you should do when starting a small business is create a new bank account.

#Paying federal taxes for small business pro#

💡 PRO TIP: To see your net sales, cost of goods sold, and gross profit, view the Finances summary page in Shopify admin. So it’s critical to understand your gross and net profits to increase profitability and expand your company.” However, after deducting your expenses, your net income might be as little as $10. “For example, if your product costs $100 to create and sells for $150, your gross profit is $50. Lily Will, founder and CEO at NiaWigs, puts this into practice: “Small-business owners frequently overlook the difference between their net and gross income.

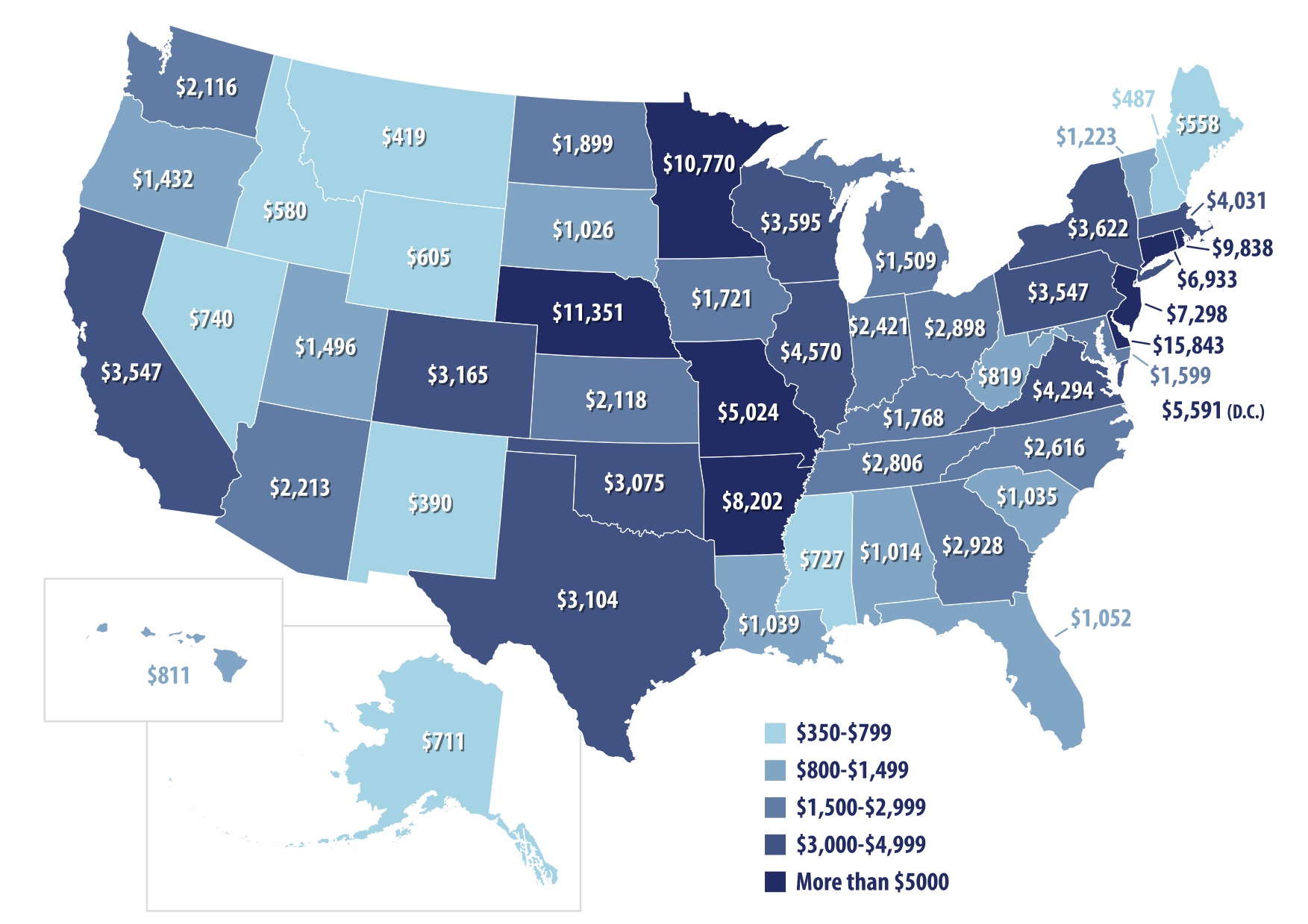

How taxes impact your businessĮvery small-business owner in the US needs to pay taxes.

#Paying federal taxes for small business professional#

Note: This guide is provided for informational purposes only and is not intended to substitute for obtaining accounting, tax, or financial advice from a professional accountant.

#Paying federal taxes for small business how to#

This guide shares how taxes impact your business, with 15 bonus tips on how to make tax season more stress-free. Managing your taxes for your retail store doesn’t have to be a headache. It’s no surprise that taxes-a bill that arrives at the end of each financial year-is the second-most important problem for small businesses in the US. Some 12% of small business owners say financial stability is the most important challenge for them, beaten only by loss of business and attracting new customers. The economic climate is still reeling from the COVID-19 pandemic.

0 kommentar(er)

0 kommentar(er)